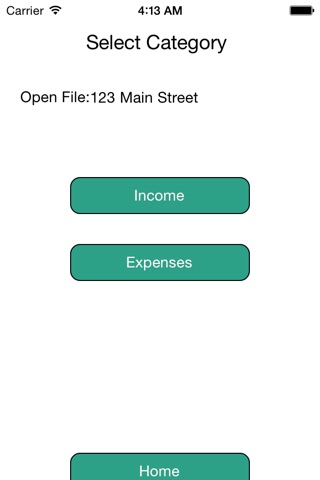

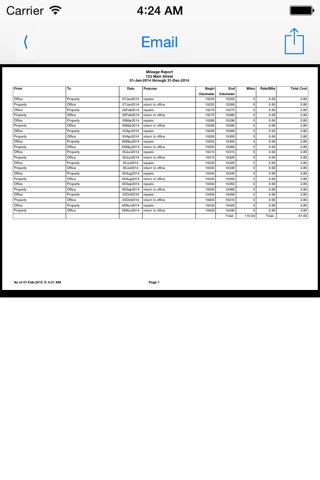

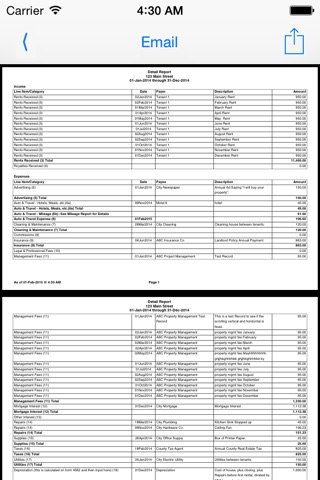

Schedule E App categorizes Income and Expenses, for Real Estate Rental or Royalties, into the Categories used by the Internal Revenue Service (IRS). There is an included module for calculating Mileage. Summary, Detail and Mileage Reports can be viewed or printed or e-mailed. You will have all the information needed to do your own Schedule E, enter it into a tax program like TaxAct, H&R Block or Turbo Tax, or give the information to your local tax preparer.

For most of us, doing our taxes is not easy or fun. This App makes it possible for you see calculated all the values you need to fill out your Schedule E. Our easy to use system and Instructions and Help file(s) give you what you need to complete the Schedule. At the end of the year, the user only needs to run a report, and use the report to directly fill out the Schedule E. See where the business is for any period; how is Income doing compared to expenses as of March, for instance.

During the year, you can see how your Income compares with your Expenses. At the end of the year, you can see how you did for the whole year, or any period you like. The Summary Report will produce the Amounts you need to fill out your Schedule E, based on your input. The Detail Report will provide those totals also, and will be what your tax consultant will want to see, along with your receipts.

With this App, you can keep track of Income and Expenses as you receive or pay them, or, do it all at the end of the year.

See our Website www.myfinancialapps.com for more information.